2022 tax withholding calculator

This calculator is a tool to estimate how much federal income tax will be withheld from your gross monthly check. This calculator is for the tax year 2022 which is payable in April of 2023.

2022 Bir Train Withholding Tax Calculator Tax Tables

The information you give your employer on Form W4.

. 2022 Federal Tax Withholding Calculator. Accordingly the withholding tax due computed by the calculator cannot be used as basis of complaints of employees against their employers. If you have a salary an hourly job or collect a pension the tax.

Based on your projected tax withholding for the year we can also estimate your tax refund or amount you may owe the IRS next April. Under FICA you also need to withhold 145 of each employees taxable. The amount of income tax your employer withholds from your regular pay depends on two things.

This page provides detail of the federal tax tables for 2022 has links to historic federal tax tables which are used within the 2022 federal tax calculator and has supporting links to each set of state. This calculator is for estimation purposes only. States dont impose their own income tax for tax year 2022.

How Your Paycheck Works. No validation process is being performed on the. Once you have a better understanding how your 2022 taxes will work out plan accordingly.

Subtract 12900 for Married otherwise subtract 8600 for Single or Head of Household from your computed annual wage. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. If you are withholding tax from a nonresident employee who works in.

For employees withholding is the amount of federal income tax withheld from your paycheck. Tax withheld for individuals calculator. For help with your withholding you may use the Tax Withholding Estimator.

Enter your filing status income deductions and credits and we will estimate your total taxes. This is a projection based on information you provide. The Tax Withholding Assistant is available in Excel format.

This calculator is a tool to estimate how much federal income tax will be withheld from your gross monthly check. It will take between 2 and 10 minutes to use. This 2022 tax return and refund estimator provides you with detailed tax results.

Choose the right calculator. Be sure that your employee has given you a completed Form W-4. The federal government collects your income tax.

This is a projection based on information you provide. During the year adjust your W-4 and manage your paycheck based tax withholding. Discover Helpful Information And Resources On Taxes From AARP.

2022 Federal Tax Withholding Calculator. The new 2018 tax brackets are 10 12 22 24 32 35 and 37. 2021 2022 Paycheck and W-4 Check Calculator.

IRS Tax Tip 2022-66 April 28 2022 All taxpayers should review their federal withholding each year to make sure theyre not having too little or too much tax withheld. Calculations are based on the alternate method of withholding in Publication W-166 Withholding Tax Guide Effective for Withholding Periods Beginning on or After January 1 2022. There are 3 withholding calculators you can use depending on your situation.

How to Use the Tax Withholding Assistant. This is a projection based on information you provide. If you are married but would like to withhold at the higher single rate please use the single rate projections table.

The maximum an employee will pay in 2022 is 911400. The amount you earn. Effective for withholding periods beginning on or after January 1 2022.

Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. If you are married but would like to withhold at the. 2022 Federal Tax Withholding Calculator.

The Tax withheld for individuals calculator is for payments made to employees and other workers including working holiday makers. We offer calculators for 2016 2017 2018. This calculator is a tool to estimate how much federal income tax will be withheld from your gross monthly check.

By the end of 2022 get your personal refund anticipation date before you prepare and e-file. Thats where our paycheck calculator comes in. Now you can easily create a Form W-4 that reflects your planned tax withholding amount.

If you are married but would like to withhold at the higher single rate please use the single rate projections table. 2022 Federal income tax withholding calculation. Number of Exemptions from MW507 Form.

Tax withholding is the money that comes out of your paycheck in order to pay taxes with the biggest one being income taxes. The design of the Form W-4 does not give you the actual tax withholding amount therefore we have created this paycheck and integrated W-4 calculator tool for you. As the employer you must also match your employees contributions.

Online Withholding Calculator For Tax Year 2022. Download the Excel Spreadsheet XLSX. Calculate your annual tax by the IRS provided tables.

Open the Tax Withholding Assistant and follow these steps to calculate your employees tax withholding for 2022. Occupational Disability and Occupational Death Benefits are non-taxable. If you are withholding tax.

Doing this now can help protect against facing an unexpected tax bill or penalty in 2023The sooner taxpayers check their withholding the easier it is to get the right amount. The application is simply an automated computation of the withholding tax due based only on the information entered into by the user in the applicable boxes. Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year.

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

How To Calculate Withholding Tax A Simple Payroll Guide For Small Business

Paycheck Calculator Take Home Pay Calculator

Irs Releases New 2018 Withholding Tables To Reflect Tax Law Changes

Calculation Of Federal Employment Taxes Payroll Services

How To Fill Out A W4 2022 W4 Guide Gusto

Tax Calculator Philippines 2022

How To Calculate Federal Income Tax

Federal Income Tax Fit Payroll Tax Calculation Youtube

Calculation Of Federal Employment Taxes Payroll Services

2022 Income Tax Withholding Tables Changes Examples

How To Calculate Payroll Taxes Methods Examples More

Paycheck Calculator Take Home Pay Calculator

Avanti Income Tax Calculator

Tax Withholding For Pensions And Social Security Sensible Money

How To Calculate Federal Income Tax

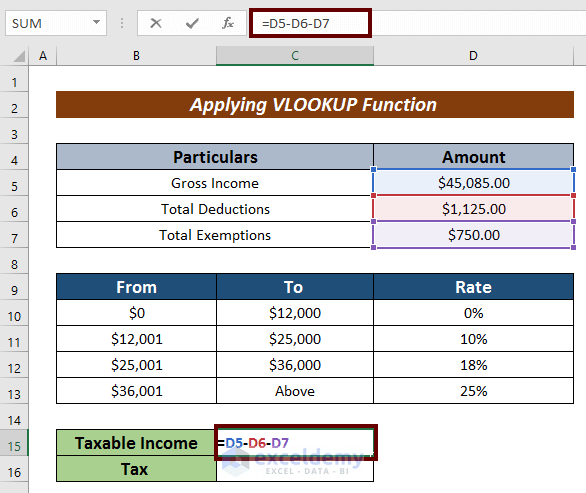

Formula For Calculating Withholding Tax In Excel 4 Effective Variants